Review and Prospects: The 7th Anniversary of China's Energy Internet

Mandy Wang, Head of Market Management and Industry Segment Management

In recent years, we have witnessed sea changes of modernisation and transformation. The energy industry is transitioning away from fossil energy towards renewables. The transport sector is switching to electricity and integrating new technologies such as The Internet of Things (IoT), mobile communication, cloud computing, Big Data, artificial intelligence and blockchain.

All this has developed into a new trend for the energy internet. Energy costs and fuel prices have decoupled and production efficiency and scale have decoupled as well. The energy sector is transforming from a resource-dependent industry to a hi-tech manufacturing and digital services industry. The new productivity changes and improvements cannot survive without new production relations, namely the policy environment. In practical terms, throughout countries across the globe, the energy transformation will not succeed without government promotion. In 2014, China put forward the new strategy of “Four Reforms and One Cooperation" aimed at achieving energy security.

At the beginning of 2020, the new direction of infrastructure building under the heading of "Digital infrastructure, transportation infrastructure and integrated infrastructure" was clarified. On 22 Sep. 2020, the Carbon Peaking and Neutrality target made its debut. On 15 Mar. 2021, at the 9th meeting of the Central Finance and Economics Committee, the Committee proposed to build the "new type of electric power system" for the first time. By the end of 2021, the prolonged planned energy economic system, officially embarked on the overall market-oriented transformation, characterised by the full entry of industrial and commercial power demand into the power market. From technological upgrading to market mechanisms, and on to the quantifiable goal of carbon neutrality by 2060, they have gradually established a new industrial development policy environment for China's Energy Internet.

Energy Internet, Part 1: Decarbonisation-oriented hi-tech manufacturing industry

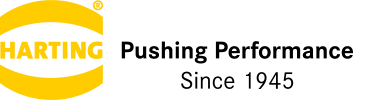

China has a noticeably scaled industry, as evidenced in power batteries, pre-owned new energy vehicles, photovoltaic, the wind power equipment industrial chain, all connecting renewable resources to the power grid, unchained by the fossil-based CO2 constraints. Most notably in the overperforming automotive industry (circa 10 % of total energy consumption) where significant new industrial forces are emerging and the number of new energy vehicles (NEVs) have increased dynamically since 2012. By the end of June 2021, China’s NEV ownership reached 6.03 million, over 2 % of all vehicles. In the Energy Saving and New Energy Technology Route Map 2.0 the China Society of Automotive Engineering states that NEV sales would reach 40 % of the vehicle market in 2030, and over 50 % in 2040.

NEV production and sales is still on a logistical growth curve. According to China NEV’s yield and life expectancy data since 2012, it is predicted that NEV ownership will rapidly grow from 2020 to 2040: a total of 190 million in 2035 and 300 million in 2040 are expected. After 2040, China's NEV market will gradually saturate and stabilise around 350 million units in 2050 (2021 sales data suggests an earlier peak). In the frontrunner city of Shenzhen, public transportation has been 100 % electrified in 2021, marking an early accomplishment of the 40 % NEV capacity. The birth and development of the information Internet cannot be separated from the large-scale development of the computer and the personal computer industry. It is believed that a solid NEV-based society simplifies and standardises the building of intelligent terminals for the Energy Internet. Currently, any NEV in China (including plug-in hybrid and BEVs) has at least 10 kWh of electricity on board (average circa 50 kWh per vehicle): All NEVs are equipped with on-board 4/5G communication systems.

Besides NEVs, mobile payment is also booming in China. A public charging pile is a technical terminal for the mobile IoT. For an end-user, scanning and electronic paying is already a routine for a charging payment.

Personal charging piles delivered by various companies also provide Bluetooth and other IoT communication technologies. From 2017 to 2021, the number of public charging piles in China increased from less than 0.22 million to over 1.14 million, while YoY growth rates recorded 52 %. For private piles, the numbers increased from less than 0.24 million to over 1.47 million, and 59 %, respectively. NEVs and their charging networks are typical digital transportation integration infrastructures, which can be viewed as a typical application of the Energy Internet.

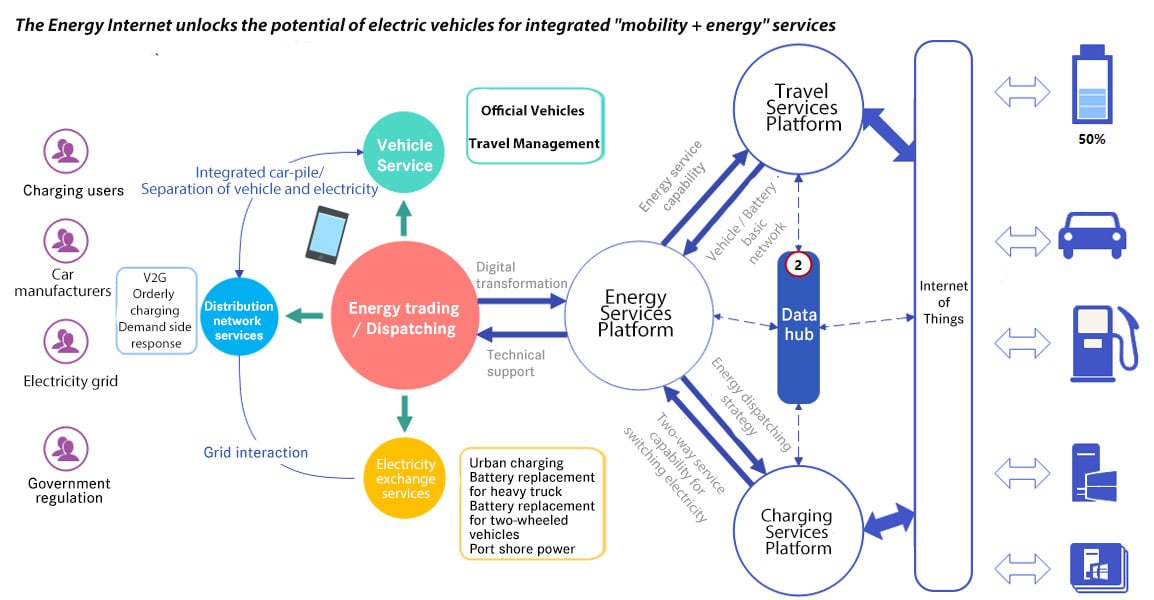

Energy Internet, Part 2: Value realisation-oriented digital services

In the beginning of 2022, China decided to promote green consumption by way of a document co-issued by nine ministeries. In a concerted effort, companies and public institutions took on the promotion of green transportation and green buildings. In the highly innovative Greater Bay Area, a new office building was equipped with a PV roof and with bidirectionally chargeable electric vehicles as well as V2G charging stations. V2G (Vehicle to Grid) technology turns electric vehicles into mobile energy storage devices, which has already been demonstrated in many projects in Europe and the United States. Shenzhen’s highlight was the interconnection between the vehicle network (for transportation), the charging network (for energy) and the virtual power plant platform. The system issues a vehicle discharging order based on user submissions and ensures that discharged vehicles retain sufficient homeward mileage. Participating vehicles can benefit from longer power battery life, cheaper power generated by PV roofs, while avoiding lined charging and voltage rise in the distribution network. They sense traffic and power loads and reduce peak shaving.

Moreover, the aggregated platform can flexibly and actively respond to the urban power grid to assist the latter’s urban power regulation objectives. In different (dis)charging scenarios, charging pile status, battery safety, vehicle models and requirements for the distribution network are comprehensively considered, as well as the directives of the virtual power plant. For this purpose, the AI-empowered Energy Robot and its distributed resource management network (DRMN) are applied to back human engineers. A DRMN is required for constant analysis and operation to realise self-sensing, self-learning, and self-evolution. It is adaptive for overall operation and control based on high precision system prediction. In this case, accessible hardware such as NEV, PV and two-way (dis)charging piles will create strong value. Additionally, the cross-system byte fusion, predictive planning and value realisation of the Energy Internet have interacted and collaborated smoothly and expediently.

Recent large scale deploying experiences in implementing the automation operational technology (OT) and systematic IT application can be applied beyond the transportation sector to include energy technologies. It will help us reduce carbon emissions all the way to carbon neutrality. An Energy Internet with profit-making power and carbon markets will connect and form a larger value network that will participate in ancillary grid services and innovative applications such as demand side response. This will fuel the rapid growth of the high-tech energy services industry and contribute to the emergence of unicorns on the energy internet. China will certainly give rise to energy aggregation platform enterprises such as AutoGrid (United States) and Next Kraftwerke (Germany). The large number of smart, connected vehicles with new energy propulsion (and their installed batteries) will form an "energy sponge", providing a massive, adaptable resource pool for the power grid. This will also give birth to a Tesla equivalent in the form of Autobidder in China.